|

CAC operates the Summer Crisis Cooling Program, or Summer HEAP. Regulations for this program may vary slightly from year to year. Under this program, any individual over 60 or with a respiratory condition may receive a one-time payment on their electric bill, and may be eligible for a new window air conditioner and/or fans. All applicants must also meet income guidelines. Contact CAC for more information at 330-297-1456 or via email at info@cacportage.net .

This year's benefits include electric bill payments, window a/c units, fans, and a/c repair for central air. Each household's benefit can be up to $500.00, and they will be eligible for a combination of these benefits based on household needs and eligibility. APPOINTMENTS

Appointments are REQUIRED. Call 1-234-703-4303 toll free or online at https://app.capappointments.com. Scheduled appointments will be conducted via telephone interview. An intake specialist will call the customer at the date and time of their appointment to start an application and will discuss the documents that are required and how to turn the documents to CAC. OPEN CALL INS

If you are unable to get an appointment, you may call in Monday through Thursday mornings starting at 8:00am until all call in appointments are full. An Intake Specialist will call clients at the date and time of their appointment, to start an application, and discuss the documents that are required, and how to get the documents turned in. For more information on the program, to obtain a medical eligibility form, or to obtain information on other agency programs and services, please access the agency’s website at www.cacportage.net. |

ELIGIBILITY REQUIREMENTS

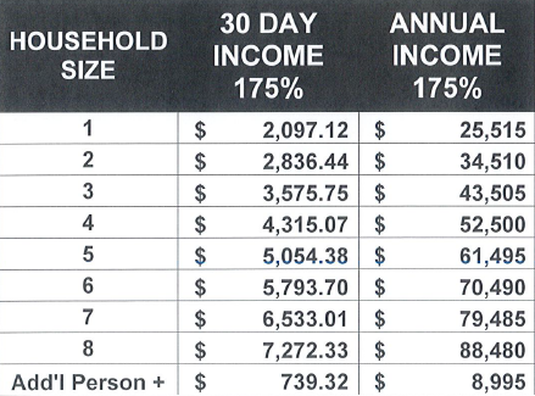

In order to be eligible for HEAP, a household income must be at or below 175% of the federal poverty guidelines for the program. The guidelines are listed below:

To be eligible, the household has to be at or below 175% of the federal poverty guidelines, AND meet one of the following criteria:

|

DOCUMENTS NEEDED:

Below is a list of the most common types of income (your individual household situation may require you to bring something that is not listed below):

- Picture I.D. for person applying on behalf of household

- Social Security Numbers for EVERYONE in household

- Proof of Citizenship for ALL household members

- All pages of most recent Ohio Edison bill

- Most recent Dominion or Bulk Fuel bill

- Proof of household income for ALL household members age 18 and over for the past 30 days is required

Below is a list of the most common types of income (your individual household situation may require you to bring something that is not listed below):

- All paystubs or employer printout that includes gross income & pay dates with any medical/child support deductions.

- SSI/Social Security, Pension, Utility Allowance, Student Loans or grants, TANF

- Child support print out for all children, or statement from child support that there is no child support order when both parents do not live in the same household.

- Help from a non-household member requires a statement from anyone that is helping you. Statement MUST have the following information included:

- Name, address, and phone number of the person who helps you

- How much money they give you

- How often money is given (specifically for the last 30 days)

- Must be signed and dated with the amount that has been given in the past 30 days.

- Notarized statement from adult household member, if representing a household that you do not live in.

- Seasonal Employment: You need the most recent 12 months of income. This can be pay stubs or seasonal employment verification form.

- Self-Employed: Any jobs you are paid cash for as well as odd jobs etc, are considered self-employment. You need your most recent IRS 1040 (entire tax return), If you do not file a 1040 form with the IRS, you must provide an IRS Verification of Non-filing letter along with a completed Self-Employment Income and expense form.

- If claiming zero (0) income you must fill out a zero income form explaining how you have been surviving on Zero income, AND may be asked to obtain a tax transcript and/or additional documentation. You can call for the tax transcript at 1-800-908-9946 or WWW.IRS.GOV

APPEALS PROCESS

Clients have 30 days from the date they receive their benefit notification to appeal decisions made

regarding their Energy Assistance Application for the Home Energy Assistance Program (HEAP),

Winter Crisis Program (WCP), Summer Crisis Program (SCP) and Percentage of Income Payment

Plan Plus (PIPP). Clients must be informed of this right when they receive their application and

again in their notification letter. Clients may appeal more than once within the same/current program

year.

Clients may also appeal if their application is not decided upon within 12 weeks. Clients must be

informed of this right at the time an application is submitted.

Grounds for appeal are:

composition or household income) they can submit an appeal to redetermine their application

such delay was the result of the client's lack of cooperation in providing necessary and reliable

documentation with which to determine eligibility.

Local Level Energy Assistance Programs - Written Appeal

Clients have 30 days from the date they receive their benefit notification to appeal decisions made

regarding their Energy Assistance Application. All appeals must be submitted in writing (letter or

email), with supporting documentation attached, to the local EAP. The client appealing the decision

must submit any applicable supporting documentation which could result in the initial decision being

reversed or modified.

The appeal review must be completed within 30 days from the date of the client’s appeal request.

The client must be notified of the decision made by the EAP within 10 days of the decision.

Appeals may be mailed to:

Community Action Council of Portage County, Inc.

PO Box 917

Ravenna, OH 44266

Attn: HEAP Coordinator

or emailed to info@cacportage.net with "HEAP Appeal" in the subject line.

Local Level Energy Assistance Programs - Hearing

Clients who were denied during the Written Appeal process may request a formal hearing within 30

days of the denial of the Written Appeal. The client must submit a written request (letter or email) for

a formal hearing. The request is to be made to the executive director of the EAP. The EAP shall

schedule a hearing within 30 days of the receipt of the notification of a request for a hearing. The

hearing shall be held at a mutually convenient place and a hearing officer shall be appointed by the

EAP. The hearing officer may be a staff member of the EAP who was not involved in the decision

That is being appealed.

Appeals may be mailed to:

Community Action Council of Portage County, Inc.

PO Box 917

Ravenna, OH 44266

Attn: Executive Director

The client must be notified of the EAP’s decision regarding the appeal within 10 days of the date of

the hearing.

State Level Energy Assistance Programs – Appeal

If the client wishes to pursue a further appeal, they must submit a State Level Appeal to the Ohio

Department of Development (Development) within 30 days of the final hearing decision rendered at

the EAP. Appeal requests must be made in writing to Development. The appeal request may be

mailed to:

Ohio Department of Development

Office of Community Assistance, Appeals

P.O. Box 2169 Columbus, Ohio 43216

or faxed to 614-387-2718 Attention: Appeals

or email to heapappeals@development.ohio.gov

Development will only review State Level Appeals which have been denied at both the Local Level

Energy Assistance Programs Written Appeal and Hearing process and contain new information, or

information not considered during the Local Level Written Appeal and Hearing process. The appeal

request must contain all the following information:

• Client's name.

• Address.

• Telephone number.

• Client number (if available).

• Reason for the appeal.

• Supporting documentation.

• Client's signature.

A decision on the appeal will be made within 30 days of receipt of the appeal request. The client will

be notified within 10 days of Development’s decision.

Federal Level Energy Assistance Programs – Appeal

If the client wishes to pursue an appeal of a State Level Appeal determination, they can submit a

Federal Level Appeal to the U.S. Department of Health and Human Services/Administration for

Children and Families. Complaints made to the federal government must be in writing and the

complaint must identify the provision of the act, assurance or certification that was allegedly

violated, and must include all relevant information known to the person submitting it.

The inquiry must be mailed to:

U.S. Department of Health and Human Services/Administration for Children and Families

Office of Community Services/Division of Energy Assistance

Low Income Home Energy Assistance Program (LIHEAP)

Mary E. Switzer Building, 5th Floor

330 C Street, SW Washington, D.C. 20201

Or fax to 202-401-5661

All appeal decisions made by the U.S. Department of Health and Human Services/Administration

for Children and Families are final

regarding their Energy Assistance Application for the Home Energy Assistance Program (HEAP),

Winter Crisis Program (WCP), Summer Crisis Program (SCP) and Percentage of Income Payment

Plan Plus (PIPP). Clients must be informed of this right when they receive their application and

again in their notification letter. Clients may appeal more than once within the same/current program

year.

Clients may also appeal if their application is not decided upon within 12 weeks. Clients must be

informed of this right at the time an application is submitted.

Grounds for appeal are:

- Energy Assistance Application was denied.

- If an application was denied, and it has been at least 30 days since they received their

composition or household income) they can submit an appeal to redetermine their application

- If the application was neither approved nor denied within 12 weeks after the application was

such delay was the result of the client's lack of cooperation in providing necessary and reliable

documentation with which to determine eligibility.

- Disagreements with the benefit/installment amount (HEAP, WCP, SCP, and PIPP).

- Household composition has changed since the application was submitted.

- If an applicant is found noncompliant and is placed under Compliance Review.

- Income has changed since the application was submitted.

- Utility provider has changed or is incorrect.

Local Level Energy Assistance Programs - Written Appeal

Clients have 30 days from the date they receive their benefit notification to appeal decisions made

regarding their Energy Assistance Application. All appeals must be submitted in writing (letter or

email), with supporting documentation attached, to the local EAP. The client appealing the decision

must submit any applicable supporting documentation which could result in the initial decision being

reversed or modified.

The appeal review must be completed within 30 days from the date of the client’s appeal request.

The client must be notified of the decision made by the EAP within 10 days of the decision.

Appeals may be mailed to:

Community Action Council of Portage County, Inc.

PO Box 917

Ravenna, OH 44266

Attn: HEAP Coordinator

or emailed to info@cacportage.net with "HEAP Appeal" in the subject line.

Local Level Energy Assistance Programs - Hearing

Clients who were denied during the Written Appeal process may request a formal hearing within 30

days of the denial of the Written Appeal. The client must submit a written request (letter or email) for

a formal hearing. The request is to be made to the executive director of the EAP. The EAP shall

schedule a hearing within 30 days of the receipt of the notification of a request for a hearing. The

hearing shall be held at a mutually convenient place and a hearing officer shall be appointed by the

EAP. The hearing officer may be a staff member of the EAP who was not involved in the decision

That is being appealed.

Appeals may be mailed to:

Community Action Council of Portage County, Inc.

PO Box 917

Ravenna, OH 44266

Attn: Executive Director

The client must be notified of the EAP’s decision regarding the appeal within 10 days of the date of

the hearing.

State Level Energy Assistance Programs – Appeal

If the client wishes to pursue a further appeal, they must submit a State Level Appeal to the Ohio

Department of Development (Development) within 30 days of the final hearing decision rendered at

the EAP. Appeal requests must be made in writing to Development. The appeal request may be

mailed to:

Ohio Department of Development

Office of Community Assistance, Appeals

P.O. Box 2169 Columbus, Ohio 43216

or faxed to 614-387-2718 Attention: Appeals

or email to heapappeals@development.ohio.gov

Development will only review State Level Appeals which have been denied at both the Local Level

Energy Assistance Programs Written Appeal and Hearing process and contain new information, or

information not considered during the Local Level Written Appeal and Hearing process. The appeal

request must contain all the following information:

• Client's name.

• Address.

• Telephone number.

• Client number (if available).

• Reason for the appeal.

• Supporting documentation.

• Client's signature.

A decision on the appeal will be made within 30 days of receipt of the appeal request. The client will

be notified within 10 days of Development’s decision.

Federal Level Energy Assistance Programs – Appeal

If the client wishes to pursue an appeal of a State Level Appeal determination, they can submit a

Federal Level Appeal to the U.S. Department of Health and Human Services/Administration for

Children and Families. Complaints made to the federal government must be in writing and the

complaint must identify the provision of the act, assurance or certification that was allegedly

violated, and must include all relevant information known to the person submitting it.

The inquiry must be mailed to:

U.S. Department of Health and Human Services/Administration for Children and Families

Office of Community Services/Division of Energy Assistance

Low Income Home Energy Assistance Program (LIHEAP)

Mary E. Switzer Building, 5th Floor

330 C Street, SW Washington, D.C. 20201

Or fax to 202-401-5661

All appeal decisions made by the U.S. Department of Health and Human Services/Administration

for Children and Families are final